Full Year Dividend is the Largest in Over 20 Years

As part of the great turnaround in income and profits created over the last five years, Sealaska businesses continue to achieve record growth. The 2019 fall distribution to shareholders will include $8 million ($15.6 million for full year 2019) from operations and the Marjorie V. Young Shareholder Permanent Fund (MVY Permanent Fund).

“We are proud of Sealaska’s growth in revenue and income and what that means for all shareholder benefits, including the distribution,” said Sealaska President and CEO Anthony Mallott. “We are also happy that our success has come from our businesses utilizing our cultural values and a passion for problem solving to address the issues facing our environment, specifically ocean health.”

“We understand that the dividend program is very important to shareholders,” said Sealaska Chair Joe Nelson, “but we are most excited about our continuing investments into our affiliates Sealaska Heritage Institute and Spruce Root.”

Dividend payments from operations and the MVY Permanent Fund will continue to grow as Sealaska’s businesses grow. Sealaska is proud of the turnaround the company has achieved since 2012, which is indicated by distributions increasing by five times over the 2014 dividend amount.

A Few Key Highlights

- Since descendant enrollment moved to an all online process in late 2018 Sealaska has welcomed 420 new shareholders.

- In 2018 and 2019 Sealaska paid out $224,000 to new descendant shareholders.

- 489 elders have been automatically issued Elder shares.

- December 2018 – present $759,080 has been paid from the Elders Settlement Trust.

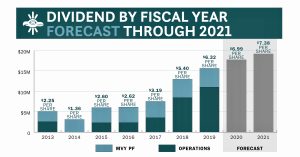

Key Highlights of Dividend Amount by Fiscal Year Chart

- The chart provides a history of dividend payments from operations and the Marjorie V. Young Shareholder Permanent Fund by fiscal year.

- Dividend payments from operations have increased each year since 2014.

- With continued business success, dividend payments from operations are forecast to grow.

All Sealaska Shareholders will Receive a Fall Distribution that Includes

- $2.24 per share payment from Sealaska operations

- $0.96 per share payment from Marjorie V. Young Shareholder Permanent Fund

Distribution Schedule for Shareholders

- Tuesday, Nov. 5, 2019 | Record Date is the last day to make changes to stock, gift stock, enroll, process estates or transfer shares.

- Tuesday, Nov. 12, 2019 | Last day to change shareholder banking or mailing information. Update information on MySealaska.com by 11:59 p.m. AKST or in person at Sealaska headquarters by 4 p.m. AKST.

- Friday, Nov. 15, 2019 | Distribution occurs

Distribution FAQ’s

Q: How did Sealaska turn around its businesses over the last five years?

A: Several years ago, Sealaska refocused its business strategy with our values and recovered from historical under performance. Businesses are now relevant, meaningful and impactful for both profit and purpose. One example of this is our investment in food, seafood in particular. That investment is now a $400 million platform for growth. We’re working to localize the supply chain and reduce the carbon footprint while we increase the value extracted from each fish. As we move forward, we’re also looking for ways to remove plastics and non-compostable packaging from the supply chain.

Q: Why does my distribution check seem lower compared to distributions by other Native corporations?

A: Sealaska is one of the largest Native corporations with more than 22,000 shareholders, so that means that the amount per shareholder can be lower than other corporations. Since inception through 2018, Sealaska has issued $691 million to shareholders in the form of distributions.

Previous

Previous