Sealaska Announces Fall 2022 Distribution

The Sealaska Board of Directors approved a distribution totaling $15.4 million to be issued to shareholders on Nov. 9. This includes $2.8 million in earnings from the Marjorie V. Young (MVY) Shareholder Permanent Fund, $7.6 in operations income and $5.1 million in Alaska Native Claims Settlement Act Section 7(j) natural resource revenue sharing funds.

Through a balanced, sustainable approach and deliberate reinvestment back into our businesses, Sealaska provides benefits to shareholders through distributions and – equally important – a robust offering of shareholder programs that support education, workforce development, cultural/language preservation and Elder needs.

“The dividend program is a critical shareholder benefit, but it is just one piece of many benefits that Sealaska provides to its shareholders and communities,” said Sealaska Board Chair Joe Nelson. “In recent years, Sealaska has been fortunate enough to create a number of new shareholder benefit programs, like the language program and the bereavement program. These programs, along with the scholarship program and Elders trust are designed to weather the ups and downs of the markets and the business cycles.”

“The dividend program is a critical shareholder benefit, but it is just one piece of many benefits that Sealaska provides to its shareholders and communities,” said Sealaska Board Chair Joe Nelson. “In recent years, Sealaska has been fortunate enough to create a number of new shareholder benefit programs, like the language program and the bereavement program. These programs, along with the scholarship program and Elders trust are designed to weather the ups and downs of the markets and the business cycles.”

The ultimate goal, according to Sealaska President and CEO Anthony Mallott, is to provide for current generations while saving for the future.

“We are fortunate that despite the economic volatility seen across the globe right now, Sealaska’s dividends remain solid,” said Mallott. “I think we’ve all been feeling the impact of the tough financial market we’re currently in. But because of the way Sealaska dividends are structured, with the five-year averaging of operations income and the permanent fund, we can help limit large movements in the dividend during years like this one, where investment markets face significant decline.”

Sealaska’s strong financial asset base provides protection against down years. The MVY permanent fund is a long-term investment fund designed to ensure that even as markets fluctuate, shareholders continue to receive stable distributions. Operations income is accounted for similarly, aiming for stability in all business climates. This is accomplished by averaging the past five years when making distributions to shareholders, rather than only taking the previous year into account.

One component of distributions that lies outside of Sealaska’s control is 7(j) natural resource revenue sharing funds, which make up a portion of the distribution seen by holders of Class B (Urban) and C (At-Large) shares. These funds can be impacted by market fluctuations – and we’re seeing that in this year’s dividend, especially given decreased investment in oil, gas and mineral development seen in Alaska over the past few years.

“Our business and financial strategy is one of longevity,” Mallott continued. “With an off year, we might see a disruption in growth, but with a focus on successful businesses addressing ocean health, we are able to weather those storms. These dips won’t impact our goal of growth and stability over time.”

The fall 2022 dividend is comparable to numbers seen in previous years. Sealaska shareholders saw $19.4 million in dividends in 2021, compared to $20.4 million in 2022.

In addition to these twice-yearly dividends, Sealaska’s Elders saw $2.5 million in elder dividends paid each year in both 2021 and 2022.

“We take a long view – a multigenerational view – and that approach is something to be confident in, no matter what the short term may look like,” Mallott said. “Opening the door for new descendants while continuing to serve original shareholders is now part of that plan.”

This distribution is the third made through the Sealaska Settlement Trust, which was passed by shareholder resolution at the 2021 annual meeting.

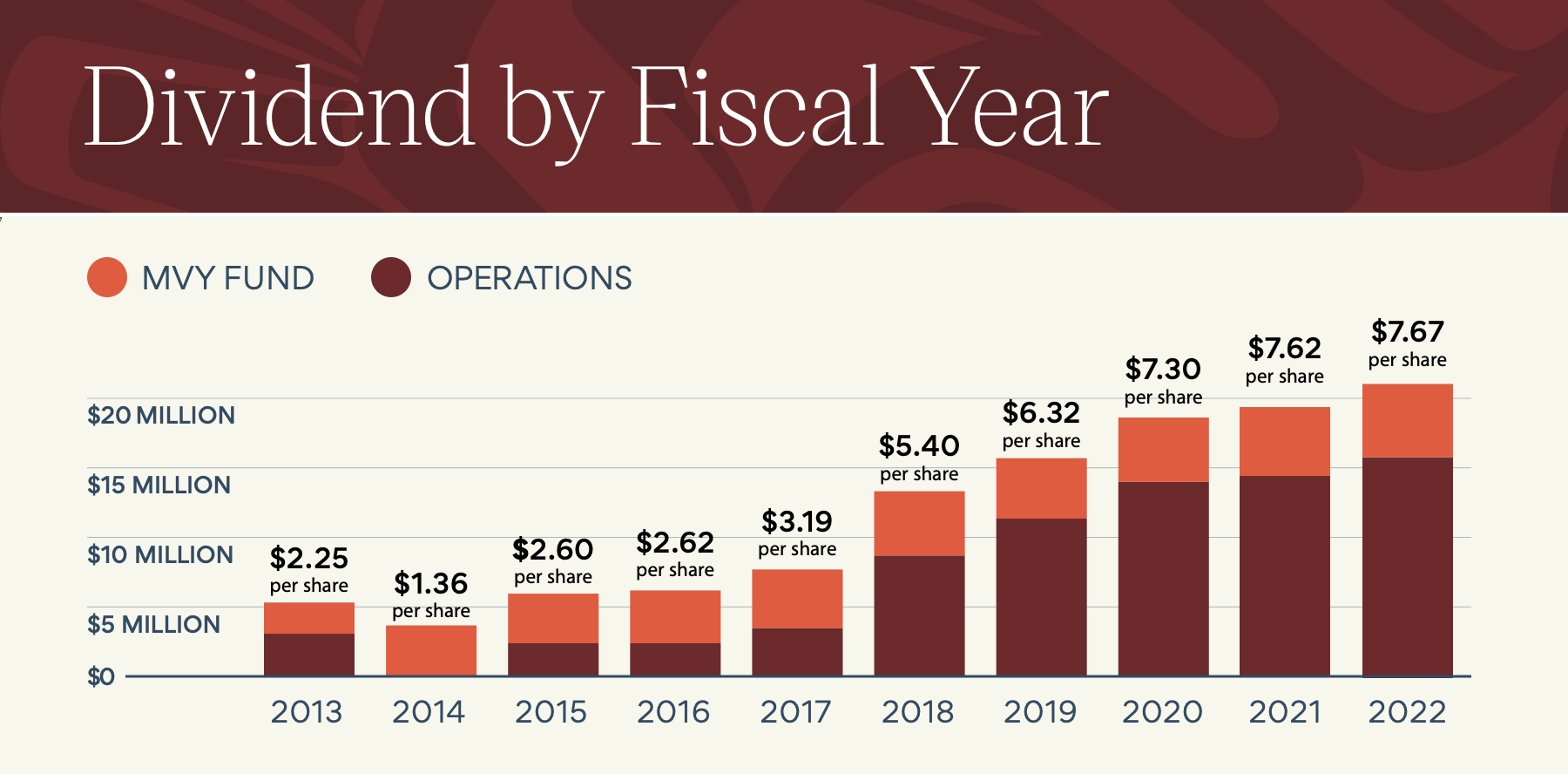

The following chart shows the history of dividend payments from operations and the MVY permanent fund by fiscal year.

Sealaska shareholders will receive a fall distribution that includes:

Sealaska shareholders will receive a fall distribution that includes:

- $2.73 per share payment from Sealaska operations.

- $1.01 per share payment from Marjorie V. Young Shareholder Permanent Fund.

- Urban and At-Large shareholders will also receive an ANSCA Section 7(j) payment of $3.21 per share as part of their distribution payment.

Friday, Oct. 28 is the record date – this is the last day for shareholders to make changes to stock or gift stock ahead of the fall distribution. Friday, Nov. 4 is the last day to update addresses or banking information. To make updates to record information, please visit MySealaska.com. Shareholders can also contact the Sealaska Shareholder Relations team directly at records@sealaska.com or 1.800.848.5921.

The fall distribution schedule:

Friday, Oct. 28 – Distribution announced, record date – all stock changes, transfers and giftings must be complete by 4 p.m. on this date.

Friday, Nov. 4 – Last day to update addresses or banking information by 11:59 p.m. via MySealaska.com or by 4 p.m. if updated in person with Shareholder Relations.

Wednesday, Nov. 9 – Distribution Day.

Previous

Previous